Global gold prices surged to an all-time high during Monday’s trading session, as investors sought a safe haven.

As of 11:59 AM (GMT), spot gold prices rose 1.7% to $4,584.12 per ounce, after briefly touching a record high of $4,600.33 per ounce. US February gold futures also rose 2.1% to $4,595 per ounce.

According to experts, uncertainty surrounding interest rate prospects and the US dollar is driving a strong shift of capital into safe-haven assets such as gold. Notably, news of an investigation into Federal Reserve Chairman Jerome Powell is causing investors to flock to safe-haven assets.

Zain Vawda, an analyst at MarketPulse of OANDA, argues that as policy risks increase, investors tend to seek tangible assets to preserve value.

In the currency market, the US dollar weakened while US stock indices fluctuated sharply, reflecting the cautious sentiment of investors ahead of potential changes in economic policy.

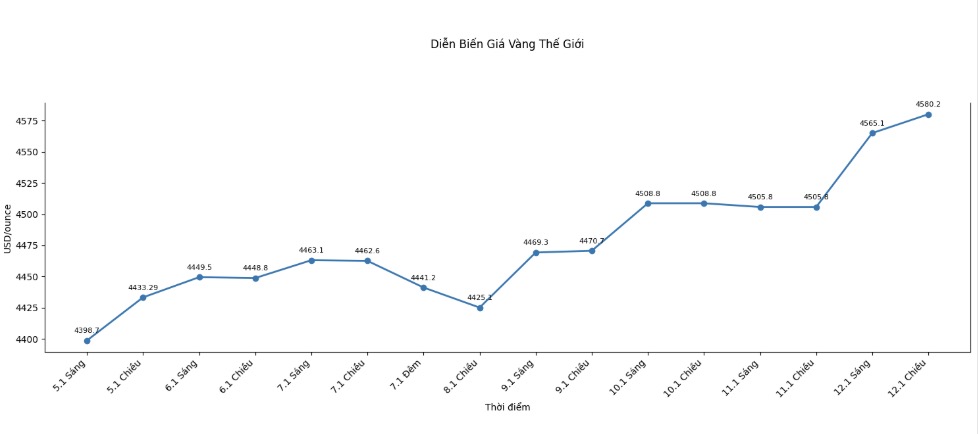

Recent movements in global gold prices during trading sessions. Chart: Khuong Duy

Recent movements in global gold prices during trading sessions. Chart: Khuong Duy

Many major financial institutions, such as Goldman Sachs and Morgan Stanley, now forecast that the US Federal Reserve (Fed) will implement two interest rate cuts this year, each by 0.25 percentage points, around mid-year and late-year. A low interest rate environment typically favors non-yielding assets like gold.

Along with gold, the precious metals market also recorded strong gains. Spot silver prices rose 4.8% to $83.78 per ounce, after setting a new record high of $84.6 per ounce during the session.

According to Zain Vawda, the narrowing gold/silver price ratio suggests that silver has better room for price appreciation in the near future, especially given continued high industrial demand.

Spot platinum prices rose 3.5% to $2,352.90 per ounce, while palladium also increased 2.5% to $1,860.43 per ounce. Earlier, platinum had reached a historical high of $2,478.5 per ounce at the end of December.

Experts predict that, given the continued volatility in the global market, capital flows are likely to continue prioritizing safe-haven assets such as gold and precious metals in the coming period.